INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- A leap in Indian aviation: Prime Minister Modi inaugurates Safran's Global MRO Hub in Hyderabad, Calls It a Milestone

- All about HAMMER Smart Precision Guided Weapon in India — “BEL-Safran Collaboration”

- India, Germany deepen defence ties as High Defence Committee charts ambitious plan

- True strategic autonomy will come only when our code is as indigenous as our hardware: Rajnath Singh

- EXCLUSIVE: Manish Kumar Jha speaks with Air Marshal Ashutosh Dixit, Chief of Integrated Defence Staff (CISC) at Headquarters, Integrated Defence Staff (IDS)

- Experts Speak: G20 Summit: A Sign of Global Fracture

Unlocking Growth

Proposing Alternative Tax Revenue Solution to Help Grow India's Business Aviation Sector

India's business aviation sector has long called for parity in import tax treatment across commercial operations, Non-Scheduled Operator Permits (NSOPs), and private aircraft. Despite ongoing engagement with the Directorate General of Civil Aviation (DGCA) and the Ministry of Civil Aviation, progress has been sluggish. High import duties continue to stifle growth.

A more constructive path forward lies in advocating for duty exemptions for NSOP and private aircraft while proposing an operations-based taxation model

A more constructive path forward lies in advocating for duty exemptions for NSOP and private aircraft while proposing an operations-based taxation model. This approach could address industry concerns without reducing government revenues.

The Consequences of the Current Tax Regime

The existing tax differential has led to several structural inefficiencies:

- Distorted Charter Pricing: Almost all private aircraft owners have opened NSOPs only to save heavy import duties. Therefore, aircraft charter rates are arbitrarily set, often based on cost recovery rather than market-driven profitability, making it difficult for commercially focused operators to remain competitive.

- Underdeveloped Management Models: India lacks distinct owner-operator and aircraft management company frameworks. Unlike developed countries where aircraft can be owned by someone wanting to invest into Aviation but managed by professional operators, current DGCA rules force even single-aircraft owners to set up NSOPs, leading to unnecessary fragmentation. Presently, 122 NSOPs manage just 400 aircraft-an inefficient use of resources and manpower. The moot reason is disparity in import duty. In an environment that already faces a shortage of experienced professionals, this fragmentation could hinder the high growth rate anticipated for the aviation sector. Additionally, the resulting inefficiencies drive up operational expenses and place an increased burden on the regulator, potentially impacting safety standards.

- Constraints on Fractional Ownership: The import tax disparity has also stifled innovative ownership models like Fractional Ownership. Such concepts, though in great demand in the west, have not seen the light of the day in India, primarily because the Government has not been able to find a solution on how to address the disparity in the import duties. Without addressing this disparity, fractional ownership may not be possible in India.

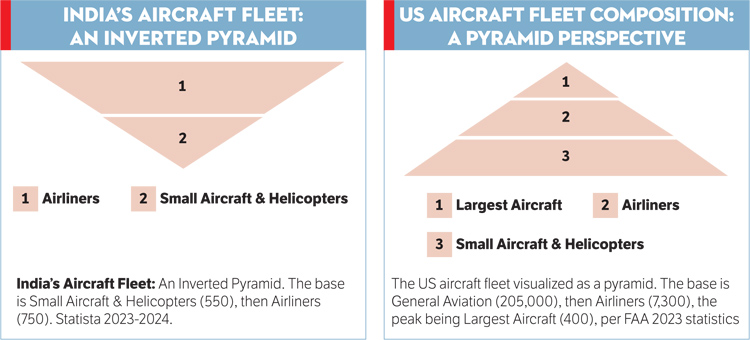

- Demand far outstrip Supply. Demand has far outstripped supply over the past several years. India, with over 250 billionaires, operates only 200 business jets compared to the USA's 15,000 for 600 billionaires. Small aircraft, which are crucial for regional connectivity and economic upliftment, are disproportionately underrepresented.

Unlike developed countries where aircraft can be owned by someone wanting to invest into Aviation but managed by professional operators, current DGCA rules force even single-aircraft owners to set up NSOPs, leading to unnecessary fragmentation

Small Aircraft as Catalysts for Growth

- Aviation growth often follows a bottom-up model: small aircraft initiate connectivity to emerging regions, paving the way for commercial carriers. The Raigarh case exemplifies how air connectivity transforms cities, supporting industrial development, tourism, and emergency services.

- Yet, the public perception that business aviation is a luxury rather than a necessity continues to undermine its developmental role. This misperception has led to an inverted pyramid—too few small aircraft and a heavy reliance on large airliners—slowing down route development and regional connectivity.

A Constructive Alternative: Tax Operations, Not Imports

While both the DGCA and Ministry of Civil Aviation recognise the harm caused by import taxes, the Ministry of Finance remains unmoved, insisting on alternative revenue sources.

This article proposes a new approach: offering the Government an alternative revenue source that, once implemented, will remove barriers to models such as separate owner-operator systems, aircraft management concept and fractional ownership, and avoid excessive fragmentation in the process. This, in turn, would resolve regulatory overload and the shortage of experienced manpower, paving the way for a renaissance in India's business aviation industry—creating the ideal pyramid structure. It is recommended that, instead of taxing imports, taxes should be collected based on operations.

It is significant to note that if the current business environment is not supported with corrective measures, then by 2030, the Indian economy will miss out on more than 1,700 crore worth of direct contribution to its GDP on an annual basis

Let us see How?

Import tax is recommended to be reduced to zero, as it was in 2007 and as is common in many developed economies. This measure would eliminate the inconsistencies discussed above and, could potentially triple the growth of business aircraft.

The removal of import taxes would inevitably result in a loss of revenue for the Government. To address this, it is suggested to shift the tax burden to aviation operations. Importantly, the proposed operational tax should target only those flights undertaken for convenience or luxury purposes. It is unfair to tax operations related to public services-such as medical or religious tourism, law enforcement, firefighting, or emergency support to civil authorities. Additionally, flights to unserved airports should be exempt from this tax, while those to underserved or well-served airports should incur a rate higher than the current GST. The tables provided below offers a detailed illustration of this proposal.

Assumptions

Definition of Airports

| Unserved Airfields | Underserved Airfields | Well Served Airfields |

|---|---|---|

| No scheduled flight | Upto 1 scheduled flight morning and evening each from a given DGCA Flight Information Regions (FIRs) | More than 1 scheduled flight morning and evening from a given FIR |

Distribution of Aircraft in the Country

| A | Total | INR Cr | 17 | 42.5 | 85 | 170 | 425 | |

|---|---|---|---|---|---|---|---|---|

| B | Existing | 400 | % | 20% | 30% | 30% | 16% | 4% |

| C | Current Nos of yearly induction | 25 | B*C | 5 | 7.5 | 7.5 | 4 | 1 |

| D | NSOP | % | 96% | 96% | 96% | 96% | 96% | |

| E | Private | % | 4% | 4% | 4% | 4% | 4% | |

| F | Expected induction in proposed "zero taxes on import regime" | 75 | B*F | 15 | 22.5 | 22.5 | 12 | 3 |

Proposal

Revenue to Government on Import, under current regime

Tax Collected at Import (Customs Duty and IGST where ITC is not permitted)

| INR Cr | 17 | 42.5 | 85 | 170 | 425 | Total | Grand Total | |||

|---|---|---|---|---|---|---|---|---|---|---|

| F | NSOP | 2.80% | C*D*A*F | 2.28 | 8.57 | 17.14 | 18.28 | 11.42 | 57.69 | |

| G | Private | 32% | C*E*A*G | 1.09 | 4.08 | 8.16 | 8.70 | 5.44 | 27.47 | 85.16 |

Comparison of Tax Collected on Operations: Current vs Proposed "Zero Taxes on Import Regime"

| Medical | Religious | Other Public Use | Unserved areas | Underserved areas | Well served areas | Total | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| H | Percentage of Flights | % | 10% | 7.50% | 7.50% | 10% | 25% | 40% | ||

| I | Hours per aircraft | h | 500 | 500 | 500 | 500 | 500 | 500 | ||

| J | Approx Charter rate | INR | 250000 | 200000 | 150000 | 325000 | 400000 | 650000 | ||

| K | Total hours flown | (B+C)*H*I*D | 20400 | 15300 | 15300 | 20400 | 51000 | 81600 | 204000 | |

| L | GST Collected | % | 0 | 5 | 18 | 18 | 18 | 18 | ||

| M | GST Collected | INR Cr | L%*K*J*10^-7 | 0 | 15.3 | 41.31 | 119.34 | 367.2 | 954.72 | 1497.87 |

| N | Total hours flown in proposed regime incl Private | (B+F)*H*I | 23750 | 17812.5 | 17812.5 | 23750 | 59375 | 95000 | 237500 | |

| O | GST in proposed regime | % | 0 | 0 | 0 | 0 | 18 | 24 | ||

| P | GST in proposed regime | INR Cr | O%*N*J*10^-7 | 0 | 0 | 0 | 0 | 427.5 | 1482 | 1909.5 |

| Q | Extra Tax Collected in proposed regime | INR Cr | P-M | 411.63 |

Extra Revenue to Government

| R | Extra Revenue collected in proposed regime | INR Cr | Q-G | 326.47 |

Note: The data used in this analysis is based on the author's experience and is approximate. Exact figures are not crucial here; the purpose is to illustrate that the Government has an alternate revenue source available, one that eliminates all the growth woes due adverse effects associated with import taxes.

Excerpts from "Industry Report by Business Aircraft Operators Association (BAOA) prepared along with Martin Consulting, 2016

Direct Contribution to GDP/ Projected Annual Loss (Rs Cr) Due to Retarded growth

| Year | As is Growth (2%) | Best Growth as per demand (12%) | GDP Contribution Lost |

|---|---|---|---|

| 2020 | 1451 Cr | 1722 Cr | 271 Cr |

| 2025 | 1505 Cr | 2344 Cr | 829 Cr |

| 2030 | 1557 Cr | 3319 Cr | 1762 Cr |

It is significant to note from the above "loss analysis" that if the current business environment is not supported with corrective measures, then by 2030, the Indian economy will miss out on more than 1700 Cr worth of direct contribution to its GDP on an annual basis. This is more than the total "Direct" contribution of the sector to the GDP currently.

Given India's democratic and socio-political context, taxing the luxury component of business aviation alone offers a pragmatic and progressive path

For the moment we have refrained from quantifying the projection of the Indirect and induced component contributions of the industry's GVA (Gross Value Added) to India's GDP.

Conclusion

The BAOA report clearly demonstrates that removing import duties can drive growth. As an interim solution, the proposed operations tax ensures continued revenue generation while avoiding the current system's distortions. This may be the answer that Finance Ministry may have been looking for.

- Shift Tax Burden to Operations: Instead of taxing imports, impose taxes on well-served routes, ensuring no loss to government revenue.

- Enable New Ownership Models: Removing import taxes will pave the way for fractional ownership, separate owner-operator concept, aircraft management companies, and reduced load on regulator by consolidation of NSOPs.

- Accelerate Industry Growth: The new taxation model will drive rapid expansion in business aviation aircraft and helicopters, enhancing connectivity and economic development.

Given India's democratic and socio-political context, taxing the luxury component of business aviation alone offers a pragmatic and progressive path. Even a modest increase in fleet size under the new model could generate greater revenue than existing import taxes, while simultaneously unleashing the sector's full potential.