INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

All Set to Grow

With aircraft acquisitions increasing by leaps and bounds in Asia, the opportunities for MRO activity are opening up

Across the globe, particularly in Asia, aircraft acquisitions are proceeding on at an astounding pace. China and India are two huge markets which are driving considerable demand for commercial aircraft as the two Asian giants enhance pancountry air connectivity. According to the Centre for Asia-Pacific Aviation (CAPA), Asia-Pacific airlines are expected to spend close to $2 trillion on new jets over the next two decades. Asia Pacific airlines will need 12,820 new airplanes, valued at $1.9 trillion during the period. The growth in intra-Asia travel, spurred by the burgeoning low-cost carriers, has created an increasing demand for single-aisle airplanes and regional aircraft.

China continues to lead the region in new deliveries. By 2030, Chinese airlines will need nearly 6,000 new airplanes, valued at $780 billion, accounting for more than 40 per cent of forecast deliveries to the Asia-Pacific region. South East Asia’s airlines, particularly from Malaysia, Indonesia and Singapore, re also growing rapidly as the region continues to develop economically.

Indian carriers, Airbus forecasts, will require 1,020 new passenger and 23 freighter aircraft valued at $145 billion between now and 2030.

All this means so much more aircraft maintenance related work, opening up huge opportunity. But the question is whether maintenance, repair and overhaul (MRO) is keeping abreast of the surge in aircraft acquisition?

Yes and No

TeamSAI, an aviation consulting company, has pegged the Asian MRO business to soar from $13.9 billion in 2013 to $24.3 billion in 2023. In China alone, it is estimated that MRO business will double from $3.6 billion to $7.8 billion.

With further investments in China, there is a possibility of West European and US carriers sending their wide-body aircraft to China for heavy maintenance as it would be less expensive due to low labour costs. TeamSAI estimates that there are over 80 MRO companies in China, 25 of which provide MRO services (aircraft, component and engine) to commercial operators. The consultant says that many aircraft MROs appear to be supporting Western operated international aircraft types such as the Boeing 747, 777 Airbus A330 and A380.

ST Aerospace, a major Singapore-based MRO provider, has established a joint venture with Guangdong Airport Management Corporation (GAMC) to establish a commercial aircraft heavy maintenance facility. One of the largest MROs of China is Aircraft Maintenance and Engineering Corporation (Ameco Beijing), a joint venture between Air China Limited and Lufthansa German Airlines, was established on August 1, 1989, with Air China Limited holding 60 per cent and Lufthansa 40 per cent stake. Besides airframers, engine makers such as GE, Pratt & Whitney, Rolls-Royce, Hamilton Sundstrand, Snecma and Volvo, are also involved with Chinese MRO companies.

India Lagging Behind

While there is considerable MRO activity in the Middle East and South East Asia, in India, which is expected to become one of the top five aviation markets in the world soon, the absence of MRO is telling. The lack of full-fledged MROs in India has helped the UAE and Singapore to develop as MRO hubs in Asia.

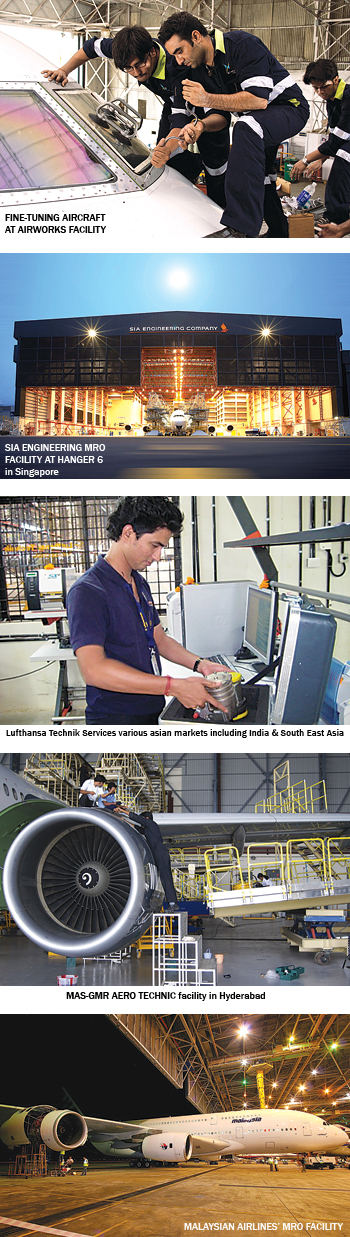

There are very few MROs in India. The nation’s first and only independent EASA-certified commercial MRO is Air Works, a leading provider of aviation services. It has a world-class facility at Hosur near Bengaluru, for base maintenance of narrow-body aircraft. It has DGCA CAR 145, EASA part 14, GCAA CAR 145, AS 9100B for Airbus A320 family; ATR-42/72 series and Boeing 737 Classic/NG series aircraft. It has an enclosed hangar to accommodate two-three regional jets or one narrow-body aircraft.

Lufthansa Technik Services India (LTSI) set up in 2008 in Bengaluru, is a fully owned subsidiary of Lufthansa Technik AG. As the successor to One Stop Airline MRO Support Pvt Ltd, the company operates a pool of components and provides materials management and spares provisioning services for Indian and South East Asian customers of Lufthansa Technik AG. LTSI also manages the home base material stock for customers in India and in some cases holds inventory for them at the Bengaluru site.

LTSI’s main focus is regional component service for Airbus aircraft of the types A319, A320, A321, A330/A340 as well as for Boeing aircraft of the types 737NG and 777. In this connection, the company cooperates closely with Lufthansa Technik’s Aircraft on Ground (AOG) Desk in Hamburg. Lufthansa Technik’s permanent presence in India through LTSI means that Indian and South East Asian customers can count on a fast, local materials service for a growing number of aircraft types and rely on highly skilled customer service in their region.

Lufthansa Technik Philippines is also a dominant firm in the field and has recently finished the construction of its third and largest hangar, capable of accommodating the A380. The company has already started an A380 cabin modification project and is now seeking certifications to perform C-checks.

The Air India-Boeing MRO which is to come up in Nagpur, has been slightly delayed. The $100-million project is slated to go operational soon. So also there are plans of MROs by Airbus which during India Aviation in Hyderabad indicated that it was in talks with global MRO firms to start a facility in India.

South East Asia Gaining Ground

In South East Asia there are over 80 MRO entities and Singapore is a key MRO hub. ST Aerospace has 30 wide-body and 31 narrow-body bays worldwide, with nine wide-body and 11 narrow-body bays in Singapore alone. However, of late, many MRO businesses have formed joint ventures with Western companies, including original equipment manufacturers (OEMs) and airlines. With aircraft reliability improving, major checks on the latest aircraft are necessary once in eight to 12 years as against four to six years on the older generation aircraft. The MROs are now contemplating reworking their revenue models.

Director of TeamSAI, David Hygate has said that with new, efficient aircraft coming into the market, profits for MROs are shrinking, unless the MRO is tied-up with one of the OEMs, as most new engine orders are accompanied by long-term service agreements with these companies. Engine manufacturers have developed a model in which aftermarket servicing is key. They have factored in life-cycle repairs and replacement parts into product revenues. As fuel efficiency is the driving factor in the development of new technologies, airframes and components, OEMs are now following the example of engine OEMs and seeing the chance to recoup investment via a stake in an MRO service.

“For component makers the attraction lies in controlling parts supply, as parts comprise the bulk of their MRO costs – certainly for engines but also for many types of components. The appeal to the aircraft makers is less easy to see, given that materials are only about 20 per cent of MRO expense, but they may see opportunity in being able to offer a comprehensive ‘cradle to grave’ service for their products,” added Hygate.

Meanwhile, independent MRO companies are thinking outof-the-box to gain market-share. For instance ST Aerospace which has been in the business for nearly four decades, has got into commercial business, moving away from defence contracts. Commercial MRO accounts for 70 per cent of an average $1.4 billion annual revenue. ST Aerospace intends to increase capabilities in China.

The Chairman and CEO of Team-SAI, Chris Doan, has stated, “Excessive demand will probably not be the cause of MRO domination and control but there is the distinct possibility that the OEMs, particularly the engine makers, might achieve overwhelming mastery of the market. Over 80 per cent of LEAP and GTF orders are sold with long-term maintenance contracts and over 90 per cent of Rolls-Royce Trent engines come with TotalCare, so these segments may fall under the control of the manufacturers. But because of the total capacity available worldwide, there is little chance of the regional providers dictating to the airlines.”

The MROs in South East Asia will have to work carefully alongside OEMs to capitalise on global growth forecasts, which see the MRO market share shifting distinctly towards the East. Hygate said, “Today, the MRO market for jet airliners is worth around $54 billion. In ten years’ time, TeamSAI predicts this will reach almost $73 billion, with engines the largest and fastest-growing segment. Training will become more important as the appetite for new staff grows and technology will probably be deployed in the form of distance learning and computer simulations. Organisations that recognise the value of training and are prepared to invest in this resource should cope best.”

There is rapid expansion of MRO facilities to the North, major facilities such as ST Aerospace in Singapore, China’s Ameco Beijing, TAECO and GAMECO as well as HAECO in Hong Kong, companies which have all been undergoing unprecedented expansion over the past few years, adding massive new hangars and expertise across the MRO spectrum. And Asia isn’t the only threat. MRO suppliers in the booming Middle East are jumping on the bandwagon. Firms such as Mubadala Aerospace in Abu Dhabi are dominating the market with aggressive expansion.

Today, the majority share of MRO remains in North America (35 per cent) and Western Europe (26 per cent), with the Asia-Pacific holding close to 20 per cent. The Asia-Pacific MRO market is now worth $11.5 billion but by 2017 is expected to reach $16.2 billion and by 2022 some $20.9 billion, around 30 per cent of world MRO turnover.

Despite the continual expansion of MRO facilities in Asia, there are worries about availability of trained engineers. Besides there are infrastructure and policy bottlenecks in several countries and it is hoped that they would be resolved. In India with the BJP-led government coming to power, there is huge expectation that the aviation sector per se will be imparted the much needed momentum.