INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

Gaining Traction

All signs point to the upcoming recovery in business jet production rates being relatively gradual and measured

Various forecasts by international market intelligence agencies have indicated that the global business aviation industry has shifted gears, moving into a positive mode, though there are hiccups, here and there. Coming out of the severe market crash in late 2008, it has been difficult for the sector, but resilient companies have held on and that has been largely responsible for the imminent turnaround. With better performance by emerging economies, the world economy is said to grow at 3.2 per cent per year on average over the next 20 years and if this is not going to prop up the business aviation segment, nothing will.

Honeywell Aerospace, Bombardier Aerospace, Embraer Executive Jets, Avinode Business Intelligence and Forecast International are all reflecting optimism in the business aviation segment.

Embraer Forecasts ‘Mild Growth’

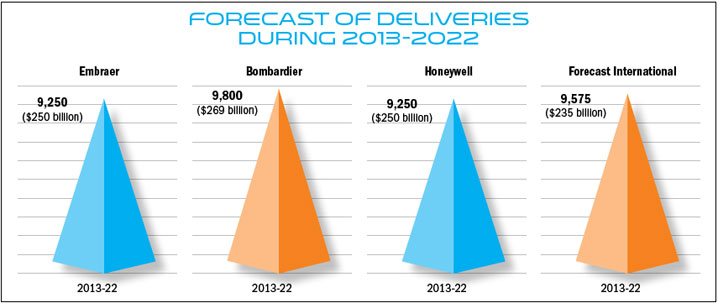

Embraer of Brazil, the third largest aircraft manufacturer has forecast that the business jet market would witness a mild growth in the next ten years, estimating the global demand at 9,250 private worth $ 250 billion.

The Vice President, Marketing and Sales, Embraer Executive Jets, Jose Eduardo Costas said that in the last decade, the number of jets sold was over 8,000 with the US accounting for nearly 50 per cent and Asia-Pacific 20 per cent. In Asia-Pacific, half of the sales were in China. He said that 2013 had been good for Embraer with sales of 119 jets, thus going up in market share to 17.6 per cent behind Bombardier which was at 27 per cent.

Richard Aboulafia, Vice President at TEAL Consultancy, said: “Embraer’s growth has slowed somewhat, but it still has enjoyed the fruits of its long-term project to become a major business jet player. In 2013, it attained a 3.4 per cent market share by value reaching a new high. But the Phenom 100 very light jet continues to suffer low numbers, along with the entire over-hyped very light jet segment. However, the imminent arrival of the Legacy 450/500 series should accelerate the company’s growth.”

Bombardier predicts 24,000 business jet deliveries valued at $650 billion from now till 2032. It anticipates 9,800 deliveries worth $269 billion from 2013 to 2022 and 14,200 deliveries worth $381 billion from 2023 to 2032. Bombardier expects the worldwide business jet fleet to grow at a compound annual growth rate (CAGR) of 3.7 per cent over the forecast period, from 14,875 aircraft in 2012 to 30,975 by 2032, net of retirements.

Bombardier said the growth of business aviation is directly related to the growth of wealthy individuals and corporate houses. A March 2013 report from Forbes estimated a record number of billionaires at 1,426 worldwide, a 16 per cent increase over Forbes’ 2012 estimate. Just like in 2011, the most significant growth in billionaires occurred in Latin America which, during 2012, saw a year-over-year increase of 54 per cent, followed by the Asia-Pacific region which saw an increase of 29 per cent.

Honeywell Hints at Modest Recovery

Honeywell in October last forecast that up to 9,250 new business jet deliveries worth over $250 billion would be done from 2013 to 2022.

The 2013 Honeywell outlook reflects an approximate three to four percent increase in projected delivery value over the 2012 forecast. Despite slightly lower unit deliveries, the expected value comes from pricing increases and a continued change in expected business jet delivery mix, which reflects the ongoing trend toward larger business jet models. “2014 industry deliveries are anticipated to be up modestly, reflecting recovery in supply side constraints and some gains linked to the projected pace of global economic recovery,” said Rob Wilson, President, Honeywell Business and General Aviation.

Avinode Forecasts Imminent Turnaround

Avinode Business Intelligence forecasts a positive 2014 for the business aviation markets in Europe and the United States. It projects a 0.7 per cent increase in business jet flights in the US. In Europe, despite several years of negative growth, the prediction is that the market will remain flat with a marginal 0.1 per cent growth.

The US economy has begun too slowly, but steadily stabilise driving up the GDP, stock markets and corporate profits. It said that the US regions would be a bag of mixed fortunes. While most of the regions are predicted to fare well over the coming year, the South and West are expected to once again, lead the pack with 1.0 per cent and 0.9 per cent growth respectively. Meanwhile, the Midwest is projected to remain fairly level with a marginal 0.1 per cent decline in flight activity, while the Northeast is forecast to see an increase of 0.4 per cent during 2014.

Avinode predicts that 2014 will be a mixed bag for the two regions that make up the European continent. Northern Europe, which tends towards business travel, is forecast to experience a 0.9 per cent decline in actual flights during 2014. The more leisure travel oriented southern region on the other hand, is predicted to see a flight activity increase of 0.7 per cent next year. After several years of decline this should be a welcome break for southern Europe, though it will not bring the region back to the previous high water mark.

Europe Rebounds

In the middle of 2013 the outlook for European business jet activity was bleak. The year had started the same way that 2012 ended, in a vast sea of red. Business jet departures out of Europe dropped an average of 3.3 per cent from 2012 numbers and in March alone they fell 8.2 per cent. In August, however, fortunes changed. Departures started to increase and with that hope finally returned to the aviation community. September, October and November continued this positive trend by finishing on par with 2012 levels.. December took it one step further by finishing 2.2 per cent ahead of the same month in 2012, which left the total activity level of 2013 down only 1.7 per cent from 2012, Avinode pointed out.

“The worst of the Euro crisis seems to be over and, although four months of stable activity is not nearly enough to cement a turnaround, we do believe that we’re now seeing the first steps of a very slow stabilisation and recovery. While we don’t anticipate a return to 2007-08 levels in the near future, we do expect that growth will return,” Avinode said.

As regards the future, Avinode said investments would start flowing once again with confidence levels up, but it cautioned that the model of seat-sharing which surfaced during the crisis was not the right one. A lot of the benefits of flying a private jet, like on demand service and complete privacy, are lost with the seat sharing model. When the price per seat is on par with or higher than a first class ticket and the business jet only serves a few fixed routes, it simply cannot be competitive.

Looking East

With the West taking a beating, the industry looked eastwards, particularly towards China. There were a number of of interesting developments in the region during 2013 such as NetJets’ Chinese joint venture and DeerJet getting into fractional shares. Embraer has forecast that China would require 805 executive jets over the next decade. The large-cabin business jet class is expected to represent 51 per cent of this demand, accounting for 78 per cent of the total value of deliveries.

China’s fleet of executive jets has experienced an average annual expansion of 27 per cent, fuelled by a 26 per cent growth of the wealthiest population, from 2008 to 2012.

Long-Range Trending

Honeywell said that higher purchase expectations continue to focus on larger cabin aircraft class ranging from super-midsize through the ultra-long range and business liner, implying these types of aircraft will command the bulk of the value billed from now until 2023. This large cabin group is expected to account for more than 80 per cent of all expenditures on new business jets in the near term. Volume growth between now and 2023 will be led by this class of aircraft, reflecting nearly 60 per cent of additional units and nearly 85 per cent of additional retail value.

“The trend toward larger cabin aircraft with ever-increasing range expectations and advanced avionics is seen more strongly than ever in this year’s survey,” Wilson said. “As a full-spectrum supplier to the industry, Honeywell has been successful in anticipating the needs of and advancing the technological capabilities of the popular super-midsize and larger aircraft in production or scheduled to enter service over the next few years.”

Forecast International’s Forecast

Forecast International predicts that manufacturers will build 9,575 business jets during the ten-year period between 2013 and 2022. The Connecticut-based market research firm estimates the value of this production at $235 billion. Business jet production has declined each year since 2008, when manufacturers produced more than 1,300 business jets. The company expected production to increase in 2014 with 708 aircraft forecast to be built and continue to rise steadily each year through 2020. In 2020, the peak production year of the forecast timeframe, about 1,166 business jets is expected to be produced.

Forecast International does not expect annual business jet production to return to the 2008 level of more than 1,300 aircraft at any time during the 2013-22 forecast period. According to Forecast International senior aerospace analyst Raymond Jaworowski, “All signs point to the upcoming recovery in business jet production rates being relatively gradual and measured. Most market indicators, such as economic growth rates, flight activity and used inventories, are somewhat mixed. On the positive side, corporate profits are strong but, amid economic and regulatory uncertainty, corporations are holding onto their money rather than spending it on new assets such as aircraft. Continuing economic improvement, however sluggish, will help unlock underlying demand in the market.”

At least initially, the recovery is expected to vary considerably in strength from region to region. Demand is already growing strongly in emerging markets in Asia, Latin America and Russia. The large North American market is showing signs of life. The European market, though, continues to be moribund.

Forecast International’s market forecast indicates that, in terms of unit production, Cessna, Bombardier and Embraer will be the top three business jet manufacturers during 2013-22. When the market is calculated in terms of the monetary value of production, the top three companies are expected to be Gulfstream, Bombardier and Dassault.