INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- The layered Air Defence systems that worked superbly, the key element of Operation Sindoor

- Operation Sindoor | Day 2 DGMOs Briefing

- Operation Sindoor: Resolute yet Restrained

- India's Operation Sindoor Sends a Clear Message to Terror and the World – ‘ZERO TOLERANCE’

- Japan and India set forth a defence cooperation consultancy framework, talks on tank and jet engines

NEXA Report

Business Aviation communities constantly had to clamour about the benefits that this segment of the industry provides for its users and to the growth of the national economy

International Civil Aviation Organisation (ICAO), the specialised agency of the United Nations (UN) that is concerned with civil aviation, does not offer any definition of ‘Business Aviation’, a term used widely in the context of usually small but frequently large aircraft for furthering the business needs of individuals and entities. Instead, it uses the term ‘General Aviation’ to indicate all civil aircraft that are not operated by commercial aviation or for aerial operations for specific tasks such as crop spraying etc.

However, International Business Aviation Council (IBAC), an International Non-Governmental Organisation (INGO) with a permanent observer status with ICAO, prescribes the following definition of Business Aviation: “That sector of aviation which concerns the operation or use of aircraft by companies for the carriage of passengers or goods as an aid to the conduct of their business, flown for purposes generally considered not for public hire and piloted by individuals having, at the minimum, a valid commercial pilot licence with an instrument rating.” IBAC further subdivides Business Aviation into commercial, corporate, owneroperated and fractional ownership. Business Aviation communities all over the world have constantly had to clamour about the benefits that this segment of the industry provides for its users and therefore to the growth and economy of the nation they are a part of. The United States (US) is the largest user of Business Aviation where it has registered a growth of 34 per cent over the last five years. A large part of this success is owed to an undertaking called ‘No Plane No Gain’ launched jointly by the National Business Aviation Association (NBAA) and the General Aviation Manufacturers’ Association (GAMA), both US aviation entities. The purpose of the undertaking is to make all endeavours to make the general public and the US establishment, more aware about the importance of Business Aviation to the US and its communities, companies and citizens. Every alternate year, NBAA carries out studies relating the use of business aircraft to the performance of the companies they serve. The latest study entitled Business Aviation and Top Performing Companies 2017 (S&P 500 Companies: Using Business Aircraft to Create Enterprise Value) and executed by NEXA Advisors can be accessed at https://www.nbaa.org/business-aviation/nexa-business-aviation-and-top-performingcompanies-2017.pdf. Its main deductions are discussed below.

Scope of the Report

The study examined the financial performance of the Standard & Poor’s 500 Index (S&P 500) companies in the period 2013 to 2017 and found that, when sorted into “Users” versus “Non-Users,” those companies deploying aircraft to support their missions outperformed those that did not in several metrics. The most important measure of impact is a company’s enterprise value, by both share amount and share appreciation; in this respect, Users outperformed Non-Users by about 70 per cent over the study period. The study concludes that business aircraft leverage key employee productivity, accelerate transactional closings and boost customer interaction. The study finally concludes that business aviation delivers extraordinary value for America’s top performing companies and contributes across the board, in both financial and nonfinancial measures. The study uses facts and evidence to arrive at the conclusion that “Business Aviation contributes meaningfully to a company’s enterprise value and continues to be a powerful tool of the best-managed companies in America”.

Methodology

The study looked at utilisation strategies employed for use of aircraft and identified these as transportation of key employees, transportation of customers, transportation of suppliers, transportation of cargo, parts and mail, transportation for humanitarian and charity missions and direct applications such as site mapping, aerial photography and even hiring out of spare flying effort to derive income for their flight departments. The net benefits from these utilisation strategies were listed by the report as employee time savings, improved productivity, strategic transaction acceleration through rapid deployment of transaction teams, protection of intellectual property through reduced exposure to commercial air travel, improved customer retention, supply chain improvement, product and production cycle improvement, employee safety and security, risk management through better oversight and control of critical processes and tasks, direct travel expense savings, increased personnel retention and social responsibility through use of business aircraft for humanitarian or charitable purposes. The next logical step was to assess the relationship between the benefits identified and their effect on enterprise value impact. The financial drivers capable of increasing enterprise value were identified as revenue or market share growth, profit growth and asset efficiency while the non-financial value drivers identified through qualitative research, were found to be customer satisfaction, employee satisfaction, innovation, risk management and compliance.

Financial Analysis

For the study, the 2017 S&P 500 companies were classified as either “users” or “non-users” of business aircraft. A “user” was defined as any company or its officers authorising the regular use of aircraft via whole aircraft ownership, fractional aircraft ownership, charter or any other form of operation as an aid to the conduct of its business and for the benefits of the enterprise. Thus the study included in its scope the use of charter aircraft as business aviation if the use was purely for business purposes. Those companies for whom data was not available for all five years of the report period, were excluded and finally 415 companies were evaluated.

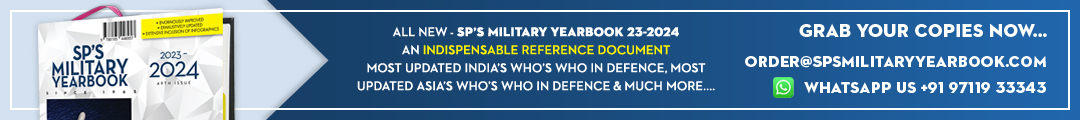

As for market capitalisation that is the all-important metric determining relative shareholder value of a company, business aviation users improved their financial results dramatically during the period of study as can be seen from Figure 1.

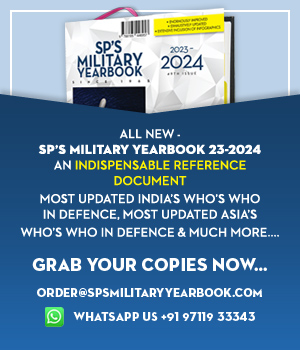

The “top line” revenue growth indicates a company’s ability to grow and more importantly, grow faster than a competitor. Revenue growth generally comes from organic growth and from strategic acquisitions and business alliances. Figure 2 shows that revenue growth for users surpassed those of non-users by a factor of 2.4 thus indicating that users are at much higher profitability levels than non-users.

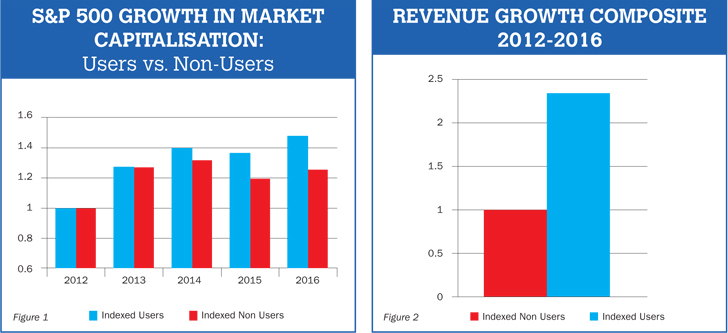

Coming to Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) or ‘bottom line’ which is a measure of a company’s financial strength and momentum, again users far outperformed non-users (see Figure 3) by a factor of 1.5.

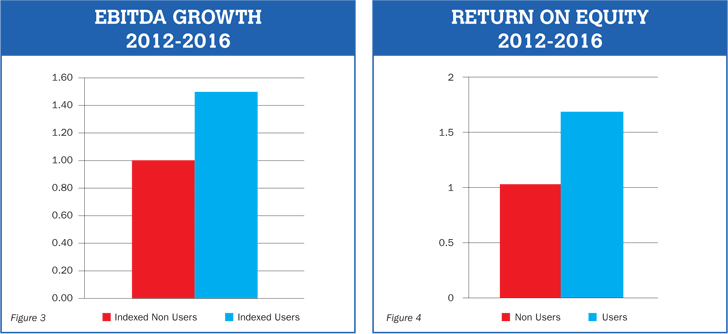

Another important element in evaluating a company is its ability to produce returns on investment equity as that is a key metric to continually attract new and larger capital for growth. Return on equity (ROE) or the ratio of net income to common stock equity tells common shareholders how effectively their money is being deployed. Comparing ROE over time reveals trends in the efficiency of applying equity to generate net income. Further comparisons with industry composites reveal how well a company is holding its own against competitors. On this metric, users were ahead of non-users by a factor of 1.6 approximately (see Figure 4), demonstrating that Business Aviation users are more efficient at using equity capital to generate net income.

Non-Financial Analysis

The major non-financial drivers namely customer satisfaction, employee satisfaction, innovation, risk management and compliance are difficult to quantify. Hence, in lieu of a quantitative analysis of these factors, the study relied on its own research as well as other sources to gauge non-financial performance. The study used lists prepared by reliable and reputed analytical and consultative sources to test if there was a correlation between use of business aviation and the prosperity as well as reputation of the company. It found an unquestionable linkage between use of business aviation and these lists which include Forbes Global America’s Most Innovative Companies List 2017, Fortune 100 Best Places to Work 2017, Wall Street 50 Best Customer Service 2016, Interbrand 50 Best Brands 2016, Fortune 2017 World’s 50 Most Admired Companies, Forbes Global 50 Top Performing US Companies 2017, Forbes 100 Most Trustworthy Companies in America 2017, Fortune 2016 Change The World Top 20, S&P 500 Top 50 Performing Stocks and CRO 100 Best Corporate Citizens 2017. In all these lists except one, more than 90 per cent of the companies were users of business aviation. Needless to say, company value is driven by market forces other than pure financials. Value expectations based on non-financials play an important part in setting current price of the shares of the company.

PERHAPS IT IS TIME NOW FOR THE INDIAN GOVERNMENT TO LAUNCH AN OBJECTIVE, IMPERSONAL AND UNPREJUDICED INTER-MINISTERIAL STUDY ON THE LINES OF THE NEXA STUDY

Concluding Remarks

The study comes out with an unequivocal message about the importance of business aviation and its uniqueness as a tool for providing an advantage to the user companies in contrast to those companies that neither wish to invest in aviation assets nor hire charter aircraft for business purposes. The facts and figures offered by the study are unambiguous and indisputable and make a very strong case for any nation to look at business aviation as a necessity and a national asset. Most international companies such as those in the US discussed above, have realised the contribution of business aviation to business and are using a combination of privately owned aircraft, charter aircraft, fractional ownership models and also commercial flights to act as ‘time multipliers’ in pursuit of company objectives by utilising working time on board aircraft including for private and confidential discussions on own aircraft. So have the governments of developed nations who are striving to nurture Business Aviation through incentives and motivations. In India, however, this realisation has touched only the users and not the establishment which provides the regulatory and infrastructural framework for the progression of Business Aviation. Perhaps it is time now for the Indian government to launch an objective, impersonal and unprejudiced inter-Ministerial study on the lines of the NEXA study discussed above. Such a study could disabuse the government of the idea it appears to harbour that business aviation is luxury and not a necessity.